Renewable Gas Panorama 2020

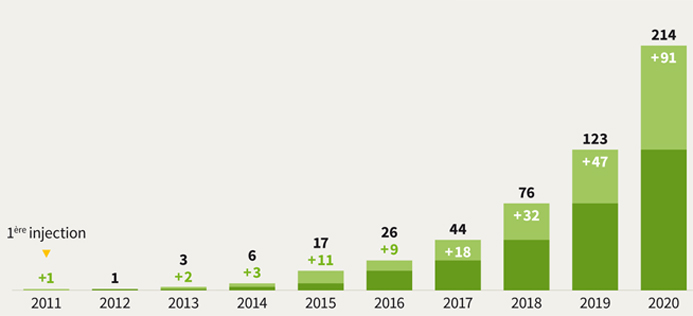

With 214 operational facilities, the biomethane production for injection sector is undergoing large-scale development.

Biomethane injection's strong momentum since 2015 is the result of investment and collaboration by all sector stakeholders. The biomethane production sector has seen many key changes in terms of economic support and regulations. It now finds itself at a turning point, with a commitment to excellence needed to successfully scale up.

More than ever, 2020 confirms this trend with the commissioning of 91 new sites in France, bringing the number of facilities connected to French gas networks to 214 at end-2020. The year-on-year quantities of renewable gas injected into the networks has almost doubled, reaching 2,207 GWh1 this year. The maximum annual injection capacity for all production sites reached 3,917 GWh at end-2020 compared to 2,157 GWh at end-2019 (i.e. the equivalent to the annual consumption of more than 320,000 gas-heated households).

Sector stakeholders continue to support a growing number of projects of various sizes and types, to encourage their completion, and to remain on track towards reduced production costs.

1 TWh = 1,000 GWh = 1,000,000 MWh = 1,000,000,000 kWh = equivalent to the average consumption of 80,000 households.

Nombre total de sites en service et évolution annuelle

Source: networks operators

An increasingly virtuous sector committed to quality

The injection of renewable gas plays a role in the French economy’s recovery plans. Now more than ever, it offers a response to climate, socio-economic and agro-economic challenges. Biomethane production provides many services to local areas: recovering local waste (agricultural, household, industrial, agri-food, etc.), supporting sustainable agriculture, decarbonising the energy and agricultural sectors, returning digestate to the ground as a natural fertiliser, revitalising rural areas, and developing a French industrial sector. Whether as part of the Sector Strategy Committee or though labelling strategies alongside ADEME (QualiMetha), work carried out in 2020 gives stakeholders the benchmarks they need to reap the benefits of biomethane production and develop it sustainably.

The upskilling of value chain players and the structuring and professionalization of the sector has led to more than 7,300 direct and indirect jobs in 2020. On its own, the biomethane production sector creates an average of three to four local jobs per facility, solely in the areas of operations and maintenance, which cannot be outsourced. Renewable gas also contributes to the energy independence of France and its regions, with the production of a renewable energy that can be stored in the networks and produced close to consumption areas.

Improved cooperation of network operators and the Right to Injection

Over the past year, gas network operators have made significant efforts to define connection zones and give project owners increased visibility. This inter-operator work, which is part of the Right to Injection, sets out the network diagrams that best promote the connection of biomethane production projects. At the end of March 2021, 216 zones were approved by the Energy Regulatory Commission (CRE), representing investments estimated at €900 million, with a view to covering the whole of France within one to two years.

An economic framework that is not yet established

The sector sets out biomethane development objectives in its new Multiannual Energy Programme (PPE) published in May 2020. However, concerns remain about their lack of ambition. The target of 6 TWh in 2023, rising to 14-22 TWh in 2028, is insufficient to achieve the target set in the Climate Energy Act of 10% of gas consumption being covered by renewable gas in 2030.

In 2020, to provide sustainable solutions supporting injected biomethane, the sector proposed extra-budgetary financing mechanisms to replace the current system. These were the subject of a consultation launched in February 2021 by the public authorities.

The PPE also plans pyrogasification experiments, with operators launching actions in 2020 to bring projects to the territories. However, the development framework for these experiments in yet to be set. The same is true for implementing the provisions of the Climate Energy Act on innovative biogas sectors, which could lead to the emergence of other sectors such as hydrothermal gasification or anaerobic digestion-methanation coupling. Moreover, while the PPE’s Power to Gas target is very limited, the measures adopted at end-2020 as part of the France Recovery plan could change this situation, particularly for the production and use of hydrogen.

Finally, long-term visibility and stability must be provided to support the sector and strengthen the involvement of funders. Reforms to guarantees of origin and the future support framework, based on a balance between the revised purchase price and calls for tender, must be implemented in consultation with the sector.

Publications