Update on the gas forecasts for winter 2022-2023

The first gas system forecasts for winter 2022/2023 were unveiled back in September. Now that we are halfway through the gas winter, GRTgaz has issued updated forecasts for the end of the winter.

Key takeaways:

- Given how the winter has been up until now and the fact that gas stocks are still very high, the risk of any kind of a deficit for the rest of winter 2022-2023 seems extremely low.

- The risk of any kind of daily deficit has also practically vanished. A residual deficit over a few days remains, however. This could happen in the event of a drop in supply coinciding with a cold snap.

- Although the Ecogaz indicator ehas been green since the start of the winter, the results of recent simulations factor in people's reduced gas usage. Making more efficient use of gas therefore remains essential.

- Gas stock levels are historically high (as of 15 January 2023, they accounted for 106 TWh (80%) of power, up from an average of 55% over the last six years by the same date). However, these levels are expected to fall significantly over the next few weeks so as to comply with the technical “breathing” constraints of French gas stores.

- Following a period from the end of November until mid-December marked in Europe by temperatures that were colder than the seasonal norm together with significant amounts of electricity being generated by gas, gas prices have now fallen considerably.

- France plays a major role – it is both a gateway and a transit country involved in supplying Europe with gas.

The year is off to a good start

Consumption that is 12.8% lower in climate-adjusted data since the unveiling of a national energy efficiency plan last summer

This fall between 1 August and 15 January can be explained by both customers and manufacturers connected up to the gas distribution networks and gas transmission networks using less gas (13% less and 24% less, respectively). The reduction is partly offset by an increase in the consumption of electricity generated by gas-fired power plants, which have had to work hard to compensate for lower levels of availability across France's nuclear facilities (23.3% increase).

>> Gas consumption overview in France for winter 2022 - 2023

Storage levels still crucial and well filled to see out the current winter

At the start of this gas winter (1 November 2022), stock levels were 7 TWh higher than predicted in the simulations that were published in mid-September.

After a cold snap in early December during which high demand was placed on gas stores, the milder weather followed by the period of calm between Christmas and New Year were opportunities to restore them.

The current level (as of 15 January 2023) is 106 TWh (80%), compared with an average of 55% over the last six years on the same date.

LNG terminals have played a major role in maintaining gas supplies this winter

LNG imports have increased a great deal. 87.7 TWh were unloaded at French LNG terminals between 1 November and 15 January 2023. That's 41% higher than the previous record set for this period. Over this period, LNG inputs accounted for some 75% of energy consumption in France; 1391 GWh/d of peak throughput available, namely 58 GW of power (approximately the capacity of 58 nuclear power plants).

Given the high gas stores across Europe and on the global markets, a reduction in LNG inputs recently got underway.

France is stepping up its role as a point of entry and transit country for supplying Europe with gas

For the period starting 1 November and ending on 31 December 2022, compared with the same period in 2021:

- LNG supplies are significantly higher,

- France has started importing from Spain,

- since October 2022, the interconnector with Germany has been used to export gas

- the gas flow between France and Belgium has reversed and exports to Switzerland have dramatically increased

- imports from Norway are still high, despite a fall over the first half of December.

Forecasts for the end of the gas winter

No risk of a global volume deficit for the rest of the winter

The simulations conducted in September based on hypotheses involving significant imports from Norway in the form of LNG showed that, depending on what kind of winter we were going to have, there was a risk of significant global gas deficits over the winter (up to 16.2 TWh).

Based on these same hypotheses, given the early winter that we had (globally mild, despite three colder weeks) and the stores that are still extremely high today, such deficits now seem highly improbable.

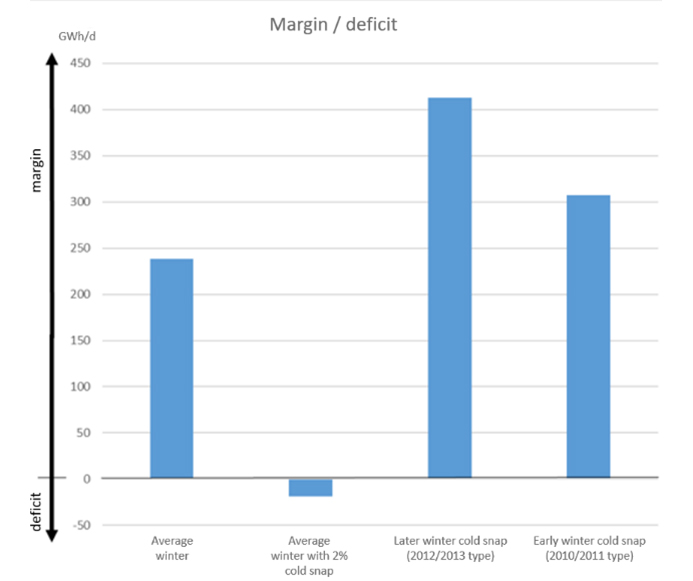

There is still a slight daily deficit risk only if there is a cold snap

Since 1 January 2023, given the healthy gas stores as of this date, updated simulations (based on the same hypotheses that were used in September which included significant gas supplies from Norway) no longer show any kind of a daily gas deficit (except a very slight deficit of 20 GWh/d on extremely cold days).

Note: there is still a potentially significant daily deficit risk over a few days if a fall in supply coincides with a cold snap.

Press contact

Contenus liés

Gas consumption overview in France for 2023 - 2024